People tend to be nervous the first time they get a credit card, but once you learn the benefits, it’s easy to get hooked. Once a person has started seeing the rewards from their first card, and started getting daily offers in the mail, the vast array of potential credit cards available to them seems like a goldmine. You can get a high reward (but high interest) credit card for traveling. You can get a card for your favorite store. You can get a card that gives you rewards on airline miles.

But how much is too much? How much is too little? What is the correct number of credit lines to have open at a single time? The answer isn’t simple, or concrete, but here are a few guiding tips.

The most important reason that having multiple cards can be a good thing is that it’s one of the easier ways to boost your credit score. Your FICO score is based on your debt-to-credit utilization ratio, which is fancy way of saying that your debt should be less than 30% of the credit limit you have available. When all those credit limits are taken into account, it makes your overall worth higher.

The most obvious benefit to having more cards is that you also earn more rewards, whether those are airplane miles or cash. In this case, one can use credit cards as a way to make money. However, if you get too many cards, and rack up too much debt, the rewards will be outweighed be interest.

Finally, for self-employed and/or freelance contractors, having a business credit card that’s separate from your personal one makes it easier to do the books, since all business purchases would be in one account.

Every time you open a new credit card, you reduce the length/age of your credit history, which impacts your FICO store. In addition to that, every new credit card opening places a “hard inquiry,” which will nail your credit score by up to five points.

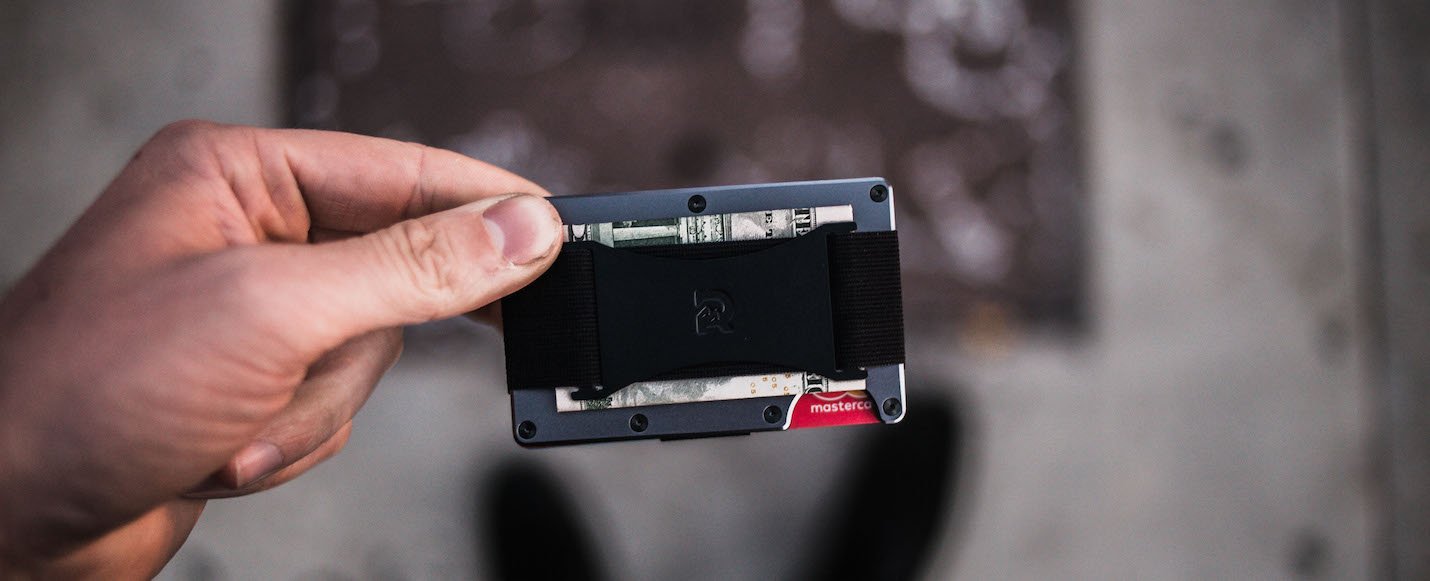

These are just temporary issues, but if you’re opening up new cards all the time, it can cause a problem. Meanwhile, having too many credit cards poses an even bigger issue: clutter. Consider how having a nice, clean, Ridge wallet cleans up a lot of the clutter from your old wallet, and compare this to a person with eight credit cards. If you’re using all eight cards, it means that you have eight separate payments to make every month, which makes it easier to either forget, or fall deeper and deeper into debt.

While we’re touting the benefits of credit cards, it’s also important to remember that having too much credit card debt can carry serious consequences. According to an analysis by personal finance company NerdWallet, as written by Time, the average household in the United States carries $16,061 in credit debt, and that number has been steadily rising over the years. It’s likely to continue rising, too, considering that the more credit debt you have, the more interest you’re going to be accumulating.

Having a negative credit score can have a huge impact on a person’s life, as it can prevent them from buying a house, qualifying for a loan, or even renting an apartment. Have fun with credit cards, but also stay responsible. Don’t take on more debt than you can handle.

According to Forbes, LowCards.com CEO Bill Hardekopf says there’s no magic number for the exact right amount of cards to have. However, amidst the different schools of thought, we can come to a pragmatic solution, that having three cards is a pretty good deal.

Here’s why: three isn’t that much to keep track of, and you can use all three for different purposes. For example, you should have one “regular” card, which you use throughout the month, and then pay off every month. The second card can be a “specialty” card—say, an airline miles card, which you only use to buy airplane tickets. The third card you can use for occasional purchases, only every once in a while, and then pay off immediately, for the sake of building your credit score.

Find the solution that works best for you, but as with anything, take care in every step of the process. It takes only seconds to mess up your credit score, and years to fix it.